| Class A Shares Dividend Payment* | |

| 2024 | 3.25% |

| 2023 | 3.25% |

| 2022 | 4.50% |

| 2021 | 3.25% |

This is currently HMECUs first Class A Offering therefore making this offering Series 1.

| Class A Shares Dividend Payment* | |

| 2024 | 3.25% |

| 2023 | 3.25% |

| 2022 | 4.50% |

| 2021 | 3.25% |

Unlike common shares, which are valued by the market and go up and down in price, Class A Shares have a fixed redemption value. The price that you pay for these shares will be the same price you redeem them for.

You can invest as little as $5,000 to as much as $75,000 when you are offered the chance to purchase investment shares.

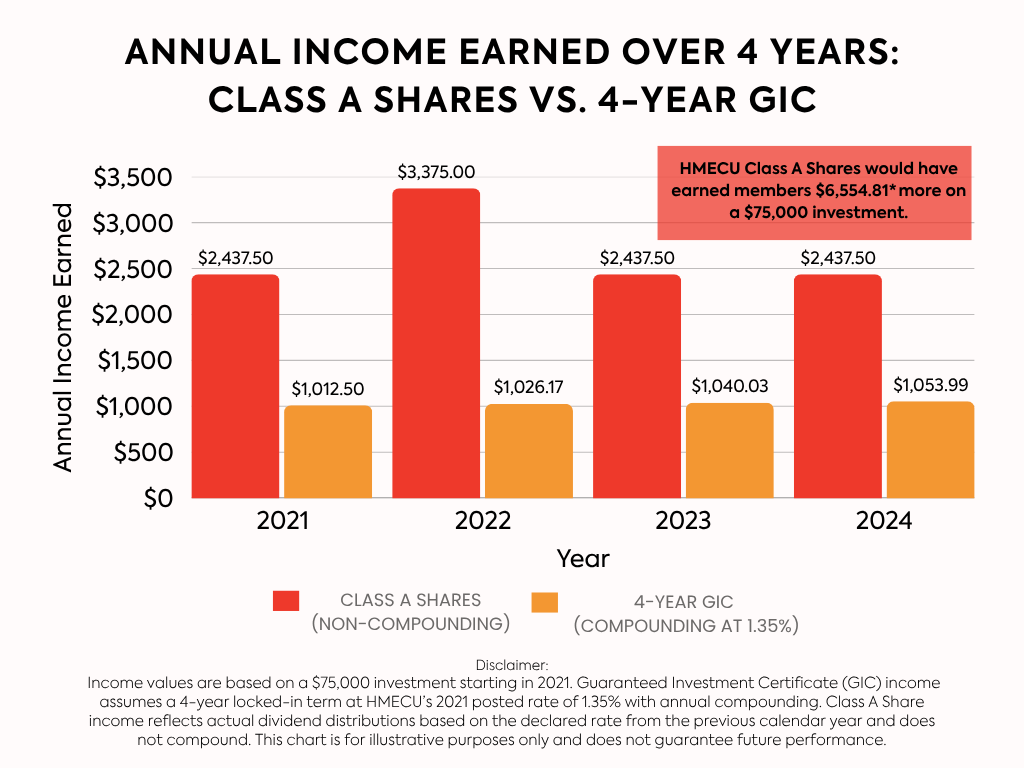

Class A Shares pay an annual dividend. The minimum rate of return is 3.25%*.

Class A Shares are a long-term investment option for members to diversify their portfolio, earn a higher than market rate of return and invest in the growth of HMECU. Funds raised through the sale of Investment Shares strengthen the capital base, or financial foundation, of HMECU. These funds will help the credit union continue to exceed financial reserve regulations and have the necessary capital to invest in new lending growth and new technology which we can use to offer expanded services to our membership.

If you have any questions about Class A Shares, please feel free to reach out to us by calling your local branch.

Share Offering Statements are avaliable in branch.

This is currently HMECUs first Class A Offering therefore making this offering Series 1.

Class A Shares are available to HMECU Members only. The income earned on Class A Shares is taxed as interest, whereas income earned on common shares is taxed as dividends. Class A Shares cannot be traded on the stock market.

No holder of Class A Investment Shares, Series 1 may request retraction during the first five years following the issuance of the shares, unless the shareholder has died or been expelled from membership in the Credit Union. In no case shall the total number of Class A Investment Shares, Series 1 retracted in any fiscal year exceed 10% of the issued and outstanding shares.

The dividend rate is 3.25%*.

You can move your funds around. If you are interested in this, please reach out to us.

Dividends are issued annually on the last business day in February each year. They are approved by our Board of Directors.

Class A Share investments are not eligible for deposit insurance by the Financial Services Regulatory Authority of Ontario.

If you are interested in purchasing shares, please click the link above or below and someone will reach out to you.

The minimum share purchase is $5,000 per person and the maximum is $75,000 per person.

Yes, you must be a member of HMECU to purchase shares.

*Dividends at any particular rate are not guaranteed, are entirely at the discretion of the Credit Union’s Board of Directors, and in certain circumstances cannot legally be paid. This investment is not insured by FSRA. This investment is only available by offering statement. This is not an offering statement. To obtain an offering statement, please visit your local branch.

You must be a Member to purchase Class A Shares.